Special Offers

Exclusive banking specials – all in one place!

Unlock Great Deals at WaterStone Bank

Earn a 3.00% 6 month fixed intro rate and a $300 Bonus all in one!

Ultimate Money Market + Checking Offer

Earn a 3.00% 6 month fixed intro rate and a $300 checking bonus when you open an Ultimate Money Market account + Checking account. Don’t miss out on this limited time offer to boost your savings and manage your money with ease, all in one place. Offer for new money only.

Open your new account online today and start saving!

Money Market + Essential Checking

Money Market + Universal Checking

If you have questions, schedule an appointment at your nearest branch location and we’d be happy to assist you.

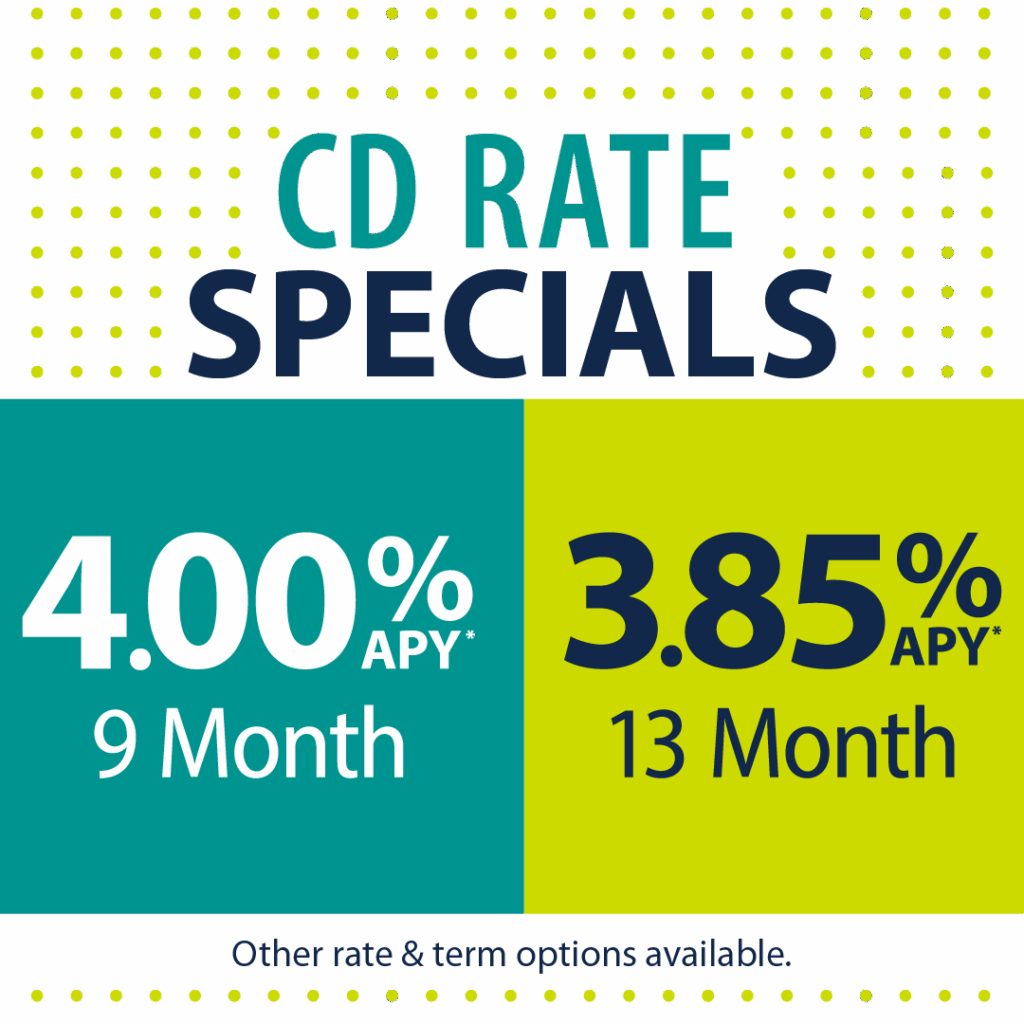

Certificate of Deposit Specials

Don’t miss out on these CD specials to boost your savings!

Save time by scheduling an appointment with your banker today!

Ultimate Money Market

Give your savings a lift when you open an Ultimate Money Market account with up to 3.00% APY*! Talk to a banker today about other available rates.

Scheduling an online appointment is a great way to save time and avoid waiting.

Home Equity Line of Credit

Imagine the Possibilities!

12 Month Fixed Intro Rate of 5.99% APR* | Variable Rate After Intro Period

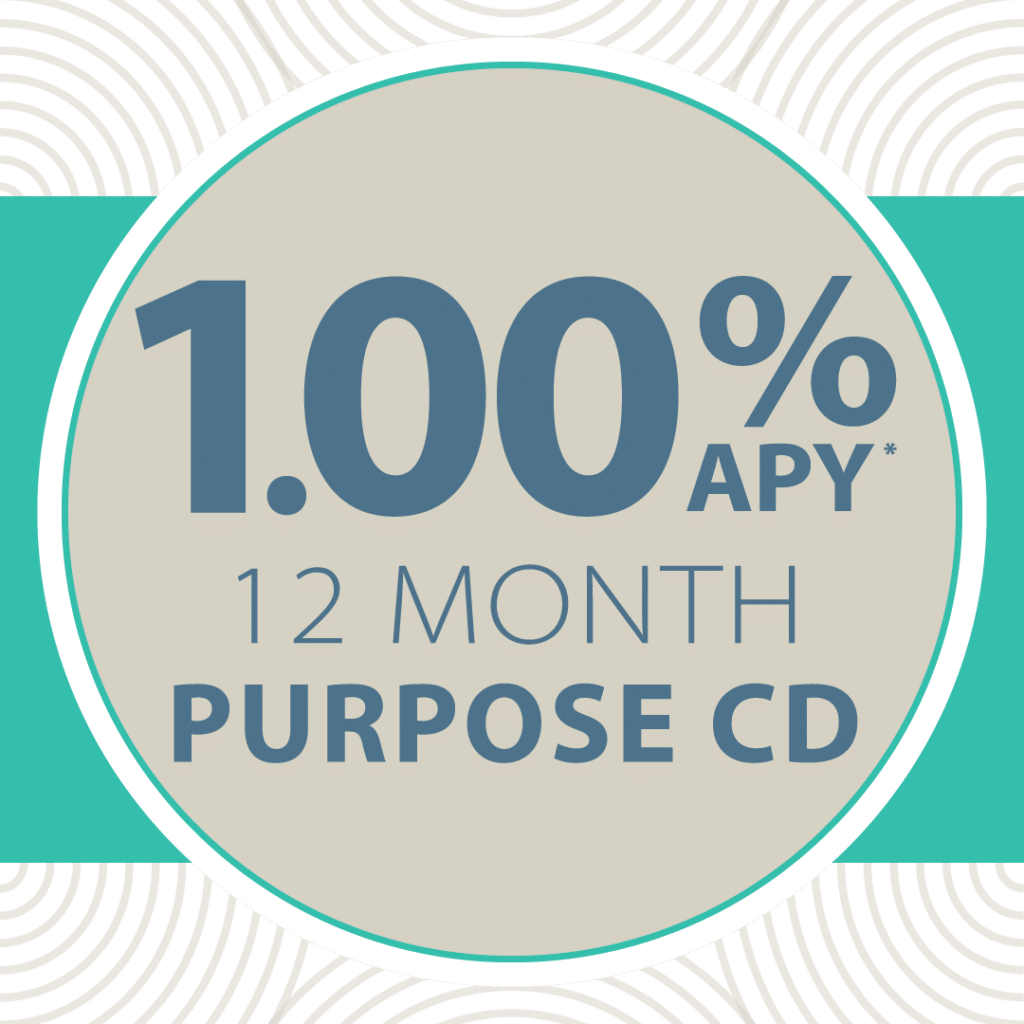

Purpose CD

1.00% APY 12 Month

Need a smarter way to grow your savings? WaterStone Bank’s Purpose CD can help you achieve your savings goal. Open your account online today!

Scheduling an online appointment is a great way to save time and avoid waiting.

What can we help you with?

Have questions about your banking needs? Our friendly team is here to help. Whether you’re opening your first account, choosing the perfect credit card, or planning your financial future, we’re ready to provide personalized support and guidance. Reach out to us by visiting your nearest branch, giving us a call, or making an appointment. WaterStone Bank is here to make banking easy and stress-free for you.

Customer Support Center

Visit a Branch

With 14 locations across Milwaukee, Waukesha, and Washington counties, our friendly team is ready to assist you with personalized service, expert guidance, and banking solutions tailored to your needs.

Schedule an Appointment

Save time by booking an appointment for personalized assistance. Open a new account, set up beneficiaries, or access services like notary, overdraft protection, and currency exchange.

Latest Insight & Education

Stay informed and empowered with our collection of articles and tools. Whether you’re looking to improve your financial knowledge or explore tips for better banking, our resources are here to guide you every step of the way.